European investors warned of the US losing its status as a reliable state for capital.

European investors are worried about instability in the US

Large European investors expressed outrage and concern over the current political instability and unpredictability of decisions in the United States of America, as this could lead to a loss of the country's reputation as a reliable place for investment. One of the largest asset managers in Europe fears that attempts by Republicans to repeal legislation supporting key sectors, including clean energy, could impact investments in the US.

'For investors, the message is clear: the US may no longer offer the reliable investment outlook that it provided just a few months ago,' said a senior portfolio manager at Allianz Global Investors.

The decision of the US House of Representatives to pass a bill that repeals the incentives provided by the Inflation Reduction Act could undermine investment strategies aimed at clean energy. European asset managers are facing a level of uncertainty and volatility that may compel them to consider alternative options in other countries, outside the US.

Negative consequences for investors

The market's reaction to news of the Republican bill was palpable: the S&P 500 index fell, and the yield on US Treasury bonds increased. President Trump, for his part, further escalated the situation by starting a trade war with the European Union. This led to a cooling of European investment markets, heightening the desire to avoid the US market due to uncertainty in energy transition policy.

Read also

- Is the Devaluation of the Hryvnia Possible: Expert Gives Currency Forecast Until the End of 2025

- The Pension Fund clarified the conditions for making voluntary pension contributions for Ukrainians abroad

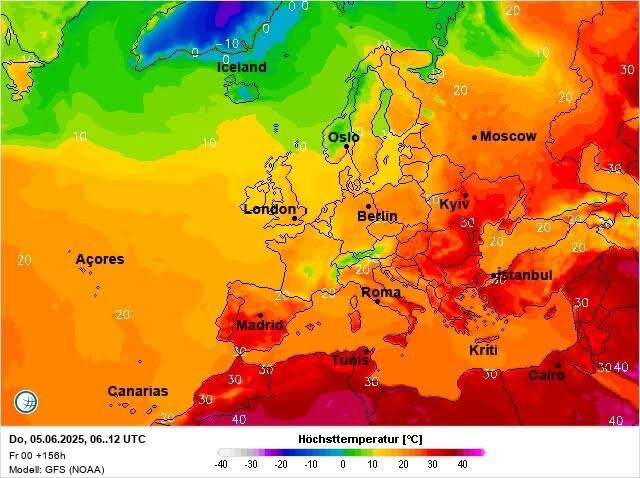

- Kyiv residents should prepare for the heat: meteorologist Didenko named the critical date

- Microsoft invests billions of dollars in cloud technologies in Southeast Asia

- The Dollar Falls Due to New Trade Uncertainty

- Goldman Sachs and Morgan Stanley: Trump May Use Other Tools for Tariffs